About Us

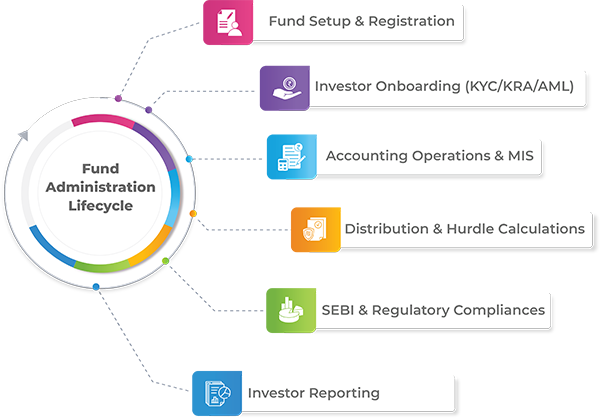

KPFS provides best-in-class fund administration and accounting services to investment funds and managers in the Private Equity, Venture Capital, and Alternative Investment domain.

We provide end-to-end Fund Administration services to leading fund houses and have developed a number of technology-enabled in-house solutions to better support the Investment Manager’s needs.

Our experience and solutions make us the expert in fund administration and we invite you to

Experience The Expertise.